How I Got My Client $11,172 on Car Loan Savings

Car finance is often marketed with attractive “headline rates” that don’t reflect the real cost to the borrower. In this story, I’ll share how I saved one of my clients over $11,000 by finding them a much better deal—resulting in a big car loan savings. This bait-and-switch tactic is common in the industry, where headline rates are used to attract clients, but the real rate is often much higher. Many borrowers don’t realize the full cost until it’s too late.

This bait-and-switch tactic is common in the industry, where headline rates are used to attract clients, but the real rate is often much higher. Many borrowers don’t realize the full cost until it’s too late.

Avoiding a Costly Mistake in Getting a Car Loan

The Problem with Headline Rates

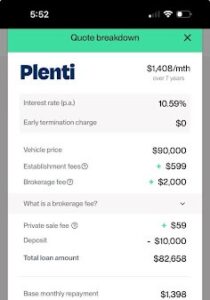

My client had recently bought a new car and was ready to sign loan contracts offered by a large online finance broker. The advertised interest rate was 8.19%, but the rate on his contract was actually 10.59%, with a comparison rate of 12.24%. This bait-and-switch tactic is common in the industry, where headline rates are used to attract clients, but the real rate is often much higher. Many borrowers don’t realize the full cost until it’s too late.

This bait-and-switch tactic is common in the industry, where headline rates are used to attract clients, but the real rate is often much higher. Many borrowers don’t realize the full cost until it’s too late.How I Got my Client $11,000 on Car Loan Savings

The Better Offer – A Rate of 7.99%

After reviewing my client’s details, I found much cheaper options than what he had been offered. Within 24 hours, he was approved for a loan with a 7.99% interest rate—far lower than the 10.59% he was initially given. Even though I used the same lender as the other broker, my approach saved him a significant amount of money because I always prioritize transparency and finding the best deal for my clients.Breaking Down Savings

The difference in my client’s monthly payments between the two deals amounted to $11,172 over the life of the car loan. The original broker stood to earn more than $6,000 in commission from this deal, but I ensured that my client got the better rate—and the car loan savings.The Truth About Broker Commissions

Morals Over Profit

Unfortunately, not all brokers prioritize their clients’ best interests. Many are driven by the commission they can earn from lenders, leading them to recommend deals that aren’t always the best for the borrower. In this case, the broker was willing to lock my client into a higher rate just to increase their own earnings. I don’t operate that way. I firmly believe that being ethical should come before profit, which is why I take pride in offering my clients the best possible rates.Accurate Personal Loan Calculator – No Misleading Rates

A Tool You Can Trust

I’ve developed a quote calculator that shows you the most accurate rates for your situation. This calculator would have shown a rate of 7.99% for my client from the start—no surprises, no inflated costs. And I’m willing to back that up with a guarantee: if I raise the rate displayed on the quote tool at the time of your application, I’ll refund you $500. I don’t believe in advertising misleading rates to lure clients in. It’s just not right.Conclusion – Make the Smart Choice for Your Car Loan

If you’re in the market for car finance, don’t be fooled by misleading headline rates. Use my transparent quote tool, which provides real, accurate rates based on your personal situation. I promise you won’t be hit with hidden fees or increased rates—just the best possible deal for your needs.Get Started with a Transparent Personal Loan Calculator

Ready to get a better deal on your car loan? Use my quote tool now and see how much you can save without having to worry about inflated rates or hidden costs. You deserve honesty from your finance broker, and that’s what I guarantee.In this Post:

January 2, 2025

December 19, 2024

Eric Burnett

The founder of EthicalFinanceBroker.com.au. With over 15 years in the finance industry, I’m committed to helping Australians make smart, transparent financial decisions. I specialize in car finance and personal loans, offering honest, practical advice without hidden fees or gimmicks. My mission is to put your best interests first, always.