How I Saved My Client $11,172—and How You Can Save, Too!

Published on December 12, 2024 | 3 min read

Every now and then, I encounter a story that reinforces why I do what I do. This is one of those stories.

My client was in the market for a car—a sleek, 4-year-old BMW X5 that she found through a private seller. To finance the purchase, she applied for a loan through a large finance broker linked to the car’s advertisement.

When the contract came back, the interest rate was set at 12.24%. It seemed high, but like many people, she thought it might be standard for used car loans. Luckily, she remembered seeing an advertised rate of 8.24%, so she decided to dig deeper.

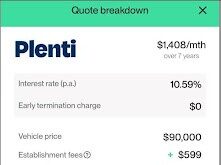

screenshot of the other broker’s rate

That’s when she found my website.

The Power of the Right Tools

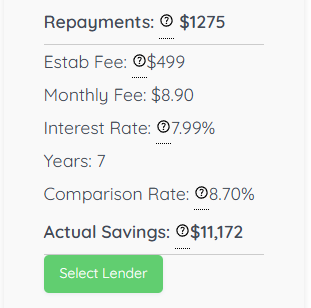

My client entered a few details about the car, answered three quick questions about her profile, and clicked “calculate.” Within moments, she was looking at a rate of 7.99%—lower than both the advertised rate and the broker’s offer.

screenshot of the result

Intrigued, she completed the application process, and within 24 hours, her loan was approved at the 7.99% rate, with the same repayments as the initial online quote.

The story doesn’t end there. Out of curiosity, she shared a screenshot of the original loan offer from the other broker. When I compared the numbers, the savings she achieved by choosing my service were over $11,172.

Why the Difference?

Here’s the frustrating part: the other broker could have offered the same deal. Instead, it seems their priority was commission, not fairness.

This is a common issue in the industry. Larger finance brokers often work with higher margins to cover overhead costs or reward introducers with hefty commissions. Unfortunately, this leaves customers paying far more than necessary.

Why My Calculator is Different

My website features a loan calculator unlike anything else in Australia. It searches through thousands of data points to find the best rates for each client and their unique profile. By automating this process, I save time as a broker and can focus on delivering value to my clients.

Here’s what you get when you deal with me:

– Instant Quotes: Enter your details and get repayment figures instantly—no need to provide your contact details.

– Fairness and Transparency: I treat every client the same, offering the best possible rates regardless of their borrowing amount or how they found me.

– Ethical Business Practices: My rates reflect what’s fair, not what maximizes profit. I believe in karma and couldn’t justify charging one person significantly more than another for doing the same amount of work.

– Your best interest first: I openly discuss all your options because I am the first to admit that I am not always the most cost effective way

How I Keep Costs Low

Unlike large networks with high operating costs, I’ve designed my business to focus on efficiency. The calculator does the heavy lifting, narrowing down the best lenders for each scenario. This allows me to save time and pass the savings directly to my clients.

The calculator even shows what repayments would look like if I charged full retail fees—so you can see exactly how much you’re saving.

It’s About More Than Just Numbers

For me, this is about more than running a successful business. It’s about helping people and treating everyone equally. That’s a principle I hold close, both personally and professionally.

I know that the way I work isn’t the norm in this industry, but it’s a choice I’m proud of. When I see stories like this client saving $11,172, it reminds me why I started this journey.

Ready to Save?

If you’re in the market for a loan—whether it’s for a car, boat, or any other purchase—give my calculator a try. It’s fast, transparent, and won’t flood you with calls or texts. If you hear of anyone looking for finance, let them know about this calculator, I‘m sure they will be grateful

How do I save?

It is simple, if you are looking for a loan with personal use, click here or if you want a loan for a business item, click here and you will see the deal you will get if your profile matches the lenders that you have selected.